Imagine you’ve just graduated and are about to move to a new city, put a lease down on your very own apartment, interview for your first adult job, and excitement is bubbling inside you. You know it will all be perfect. Except, the landlord notices you have little or poor credit and won’t lease you the apartment. So, you need to built credit without debt.

Then the employer asks to see your credit score. Do you think, is this legal? This can’t be right!? Well, they all have the ability to check on your credit. It is a score you may have been accumulating without even realizing it!

So, what is credit? It is money given to you with the assumption you will repay. You get the immediate reward without the immediate hit to your bank account. Once you are charged, it can be paid incrementally or all at once. All at once is always advised.

What about the other kind of credit? We all know that good credit is, well, good, and that we don’t want to have bad credit. Credit is what is used to decide if you are trustworthy enough to lend money to. Banks, landlords, car dealerships, and even employers may look at it to see how likely you will pay your bills on time or how responsible you are. There are many things that factor into your credit score. Things like how long you’ve had active credit if you pay on time, whether you have any debt, and the different types of credit you have used.

Build Credit Without Debt

So, how can you build credit? First, and most obvious, is to consider opening a credit card and only using it occasionally and being really sure you can pay it off in full each month. But what if you aren’t sure you want the risk of opening a card? There are other options for building credit without opening a credit card!

First, consider putting utilities in your name and setting them to automatically charge your account. This way, you know they will be paid on time (if not early) and you don’t have to worry about it. Utility companies can report to credit rating companies, so you want to be consistent. This is a really simple start.

Next, always pay your bills on time. Just like utilities, other monthly payments like your cell phone bill and cable/internet can be used to build your credit. You know you need these things, so consider taking on these bills and you will improve your score.

Another way to build credit is to pay off your federal student loans. This is something that many students and recent grads already have, so congrats! You owe money, but as you pay it down, you are on your way to setting yourself up for a strong credit future.

Download this cheat sheet to optimize underperforming posts on your website.

A Tip About Getting the Perks of a Card Without the Debt

Lastly, I know this article is about not using cards, but ask about becoming an authorized user on your parent’s credit cards. It is a nice way to ease into having credit without all the responsibility. This method is much like having a co-signer on a loan, but it works as long as your parents already have good credit. This way, the bank trusts your parents will bail you out and will teach you responsible spending habits.

As you work towards reaching small money goals like only buying what you know you can afford, paying your card in full each month, and paying utilities on time you prove you are responsible to creditors and will be able to make big, more exciting purchases down the road.

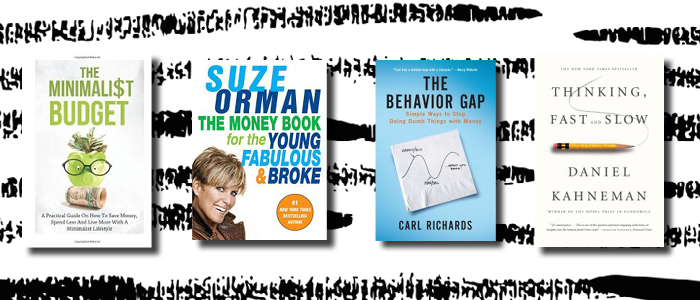

Trying to learn more about all this stuff? Here’s a short list of some really great money-talk books:

- This one helps you red flag emotional spending habits: Thinking, Fast and Slow

- The Money Book for The Young, Fabulous, and Broke — need I say more??

- The Behavior Gap – the subtitle is: simple steps to stop doing dumb things with your money

- A really really good starting point: The Minimalist Budget

Hillary is a grad student living in Indiana. She loves the Midwest, dancing, and laughing a lot. She is self-taught when it comes to money management and finance and has a passion for sharing her knowledge about it. On any given day you can find her snuggling her pup and drinking a strong cup of coffee! You can follow along with her on instagram and twitter at @Hillzy10. She’s written another helpful gem on how important it is to start saving, right now.